How To Start a Business In Toronto (plus Checklist)

Toronto is a city that offers access to a diverse consumer base, access to financial resources, and a supportive environment for both local and international enterprises. While starting a business in Toronto is an exciting venture, success hinges on careful planning and thorough research. A well-prepared business plan acts as a roadmap, outlining essential steps and guiding the business through its early stages and long-term growth.

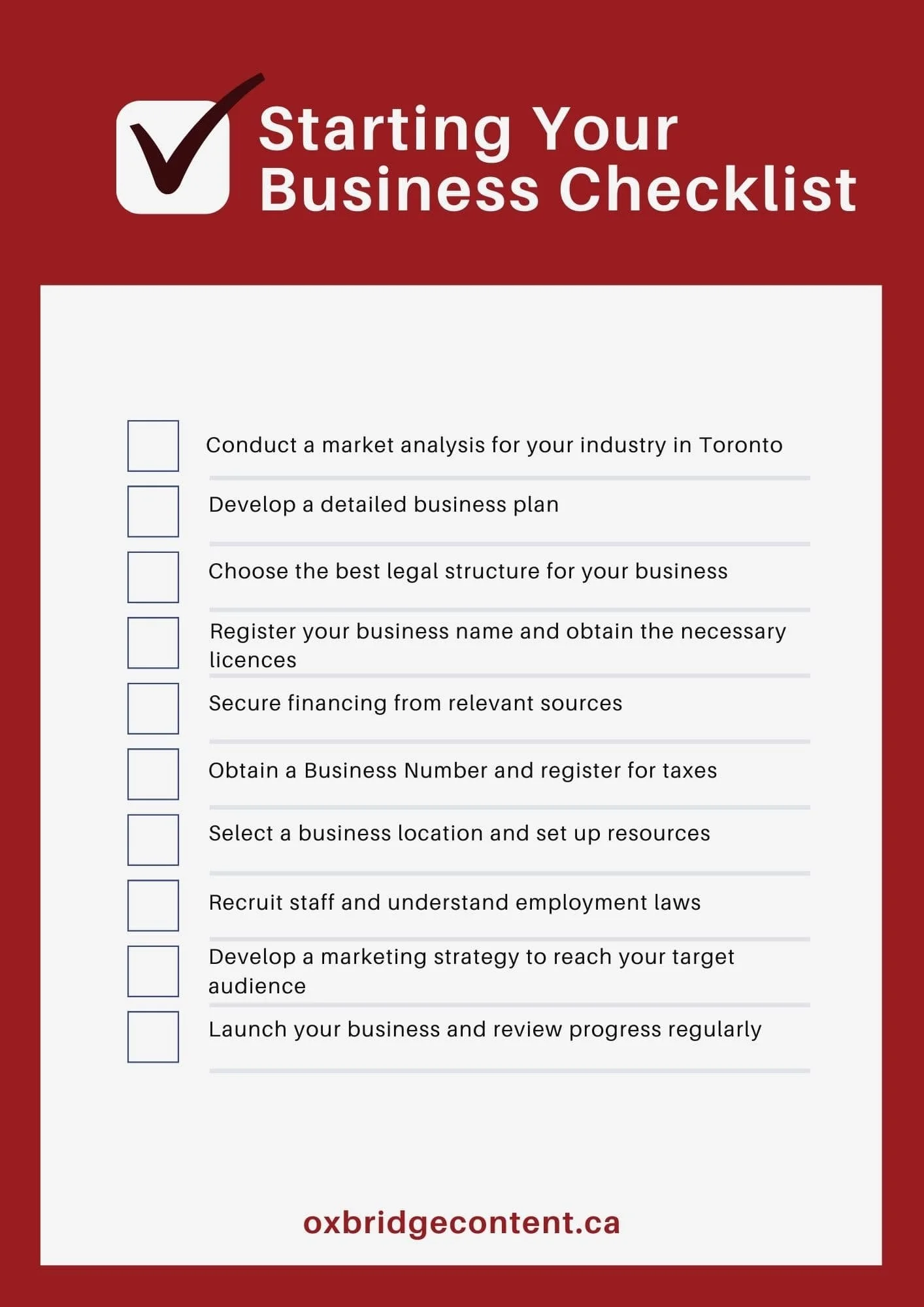

Below is a comprehensive guide on how to open a business in Toronto, including a checklist that covers every critical aspect.

How To Start a Business In Toronto

1. Understanding the Toronto Business Situation

Toronto’s diverse economic base spans finance, technology, retail, healthcare, and tourism, making it a magnet for entrepreneurs. This diversity not only provides opportunities but also comes with challenges, such as regulatory compliance and competition.

Before diving in, researching the local market, identifying industry trends, and understanding consumer demand within your sector is essential.

Connecting with local business support organisations, such as the Toronto Board of Trade and Enterprise Toronto, can provide valuable insights into the current market and offer resources to help navigate the early stages of your business venture.

2. The Importance of a Business Plan

A solid business plan is crucial when starting a business. It helps outline objectives, target markets, competitive positioning, financial projections, and strategies for growth.

A well-structured business plan not only guides the business but also attracts investors, partners, and lenders by demonstrating a clear vision and preparedness.

For those unfamiliar with the process, working with a professional business plan writing service, such as Oxbridge Content, can be beneficial. Expert writers ensure that all elements are covered in line with industry expectations, positioning the business for long-term success.

3. Choose Your Business Structure

The next step in how to start a business in Toronto involves choosing the appropriate legal structure. Options include sole proprietorship, partnership, corporation, or co-operative, each with its advantages and implications:

Sole Proprietorship: Simplest structure with minimal regulatory requirements, but the owner assumes all risks and liabilities.

Partnership: Similar to a sole proprietorship but shared between two or more people, making it ideal for joint ventures. Liabilities and profits are divided according to the partnership agreement.

Corporation: Offers the advantage of limited liability, making it suitable for larger or high-risk businesses. It involves more formalities, including annual reporting and corporate taxes.

Co-operative: Owned by an association of members who share decision-making, profits, and risks. This structure is typically used by groups with a common goal, such as local community services.

Each structure has distinct tax implications and legal responsibilities. Seeking professional advice can help identify the most suitable option, as the choice impacts not only the business’s operations but also its tax obligations.

4. Register Your Business Name and Obtain a Licence

Once you have selected your structure, the next step is to register your business name with the appropriate authorities. For sole proprietorships and partnerships, this can be done with the Ontario Ministry of Government and Consumer Services. Corporations must register with Corporations Canada if they wish to operate nationwide.

In addition to name registration, some businesses require specific permits or licences, depending on the industry and activities involved.

For example, food businesses must obtain health and safety permits, while childcare services must adhere to regulations governed by the Ministry of Education.

Failure to obtain the proper licences can lead to fines or legal issues, so it’s crucial to understand all regulatory requirements specific to your sector.

5. Secure Financing for Your Business

Funding is a major factor in determining the success of a business. Options range from personal savings and loans to venture capital, angel investors, and government grants. In Toronto, entrepreneurs benefit from various funding opportunities:

Canada Small Business Financing Program: A government-backed loan scheme that helps small businesses obtain financing from banks.

Ontario Centres of Excellence (OCE): Offers funding for tech and innovation-based businesses in Ontario.

Business Development Bank of Canada (BDC): Provides loans and venture capital for new and expanding businesses.

Angel Investors: Individuals who invest their personal capital in start-ups and may offer mentorship.

In the early stages, personal investment and bank loans are often the most accessible forms of financing. However, for businesses with high growth potential, venture capital and government grants are viable options. A well-prepared business plan will support funding applications by showcasing the potential profitability and sustainability of the business.

6. Obtain a Business Number and Register for Taxes

To operate legally in Canada, all businesses must obtain a Business Number (BN) from the Canada Revenue Agency (CRA). This unique identifier allows the business to handle taxes, payroll, and other essential services. The type of tax registration depends on the business’s activities and revenue:

Goods and Services Tax (GST)/Harmonised Sales Tax (HST): Mandatory for businesses with annual taxable revenues over CAD 30,000.

Payroll Tax: Required if the business employs staff.

Import/Export Tax: Applicable to businesses involved in international trade.

Registering for the appropriate taxes at the outset prevents complications down the line. Regular consultation with a tax professional can help navigate changes in tax laws and ensure compliance.

7. Setting Up Your Business Location and Resources

The next step in how to open a business in Toronto involves selecting a suitable location. Factors to consider include accessibility, cost, proximity to target customers, and available amenities. Toronto’s real estate market is competitive, so it’s wise to evaluate various options before signing a lease.

For some businesses, working remotely or establishing a virtual office may be more practical and cost-effective, especially in the initial stages. For physical locations, understanding local zoning laws and securing appropriate permissions is essential.

Equally important is investing in equipment, technology, and other resources essential to daily operations. Many start-ups reduce costs by leasing equipment or adopting technology subscriptions that scale with their growth.

8. Hiring and Employment Regulations

If your business will employ staff, familiarity with Ontario’s employment laws is essential. Important considerations include:

Hiring: Ensuring fair hiring practices and equal opportunity employment.

Wages and Benefits: Adhering to Ontario’s minimum wage regulations and offering statutory benefits.

Health and Safety: Complying with the Occupational Health and Safety Act (OHSA) to provide a safe work environment.

Employment regulations are designed to protect both the employer and the employees, so understanding these laws is crucial. Recruiting qualified staff who share the business’s vision is equally important, as it sets the foundation for a positive workplace culture.

9. Develop a Marketing Strategy

A strong marketing strategy is vital for reaching and engaging customers in Toronto’s competitive market. The marketing plan should outline strategies for promoting the business, building brand awareness, and generating leads. Options include:

Digital Marketing: Website, social media, and email marketing help establish an online presence and reach a broader audience.

Traditional Advertising: Flyers, posters, and local newspaper ads can be effective for reaching specific neighbourhoods.

Networking Events: Attending industry events in Toronto can help form valuable connections and gain insights from other business owners.

Understanding your target market and customer preferences will shape the most effective marketing tactics. Online and offline methods work best when combined, creating a consistent brand presence across multiple channels.

10. Launch and Review Progress Regularly

With all the groundwork complete, it’s time to launch your business. Hosting a launch event or online campaign can build excitement and attract initial customers. However, launching is only the beginning. Regularly reviewing progress is essential to identify areas for improvement and adapt to changing conditions.

Setting clear performance indicators, such as sales targets or customer satisfaction goals, enables the business to measure success accurately. Monthly or quarterly reviews allow the business to remain agile, respond to challenges, and seize new opportunities.

Starting Your Business - The Checklist

Conduct a market analysis for your industry in Toronto.

Develop a detailed business plan.

Choose the best legal structure for your business.

Register your business name and obtain the necessary licences.

Secure financing from relevant sources.

Obtain a Business Number and register for taxes.

Select a business location and set up resources.

Recruit staff and understand employment laws.

Develop a marketing strategy to reach your target audience.

Launch your business and review progress regularly.

Why Oxbridge Content Can Help You Succeed

Understanding how to open a business in Toronto requires more than an idea because it demands a solid foundation and a clear plan. Oxbridge Content specialises in professional business plan writing, tailored to suit Toronto’s unique business environment. With expertise in writing plans that address regulatory requirements, market positioning, and financial forecasting, Oxbridge Content provides the support you need to launch with confidence. Partnering with a professional service means you can focus on what matters—building your business—while ensuring a smooth and compliant start.

In summary, starting a business in Toronto involves a series of critical steps, from market research to securing financing and navigating regulatory requirements. A thorough business plan forms the backbone of this journey, offering direction and purpose. With professional guidance, you can streamline the process and set up a business that is primed for growth and success in Toronto’s dynamic market.